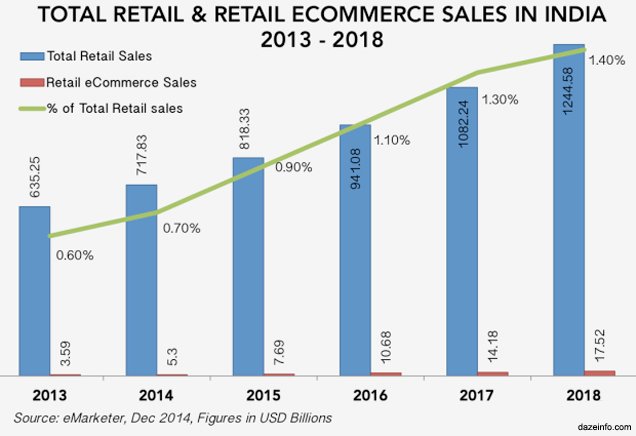

E-commerce, the next big thing waiting to take over the Indian currency by storm, is set to grow in leaps and bounds over the next three years or so, projected to reach $17.5 billion by 2018, up from the $5.3 billion it achieved in 2014, according to market research analyst eMarketer. However, the e-commerce industry in India is not growing as rapidly as it should, despite having the third largest number of internet users in the world. When matched against China, the country which leads the growth spurt in e-commerce markets with astronomical growth rates, despite the relatively high internet censorship in the country, India’s growth rates, and acceptance of e-commerce and internet-based retail is a cause of concern for market analysts.

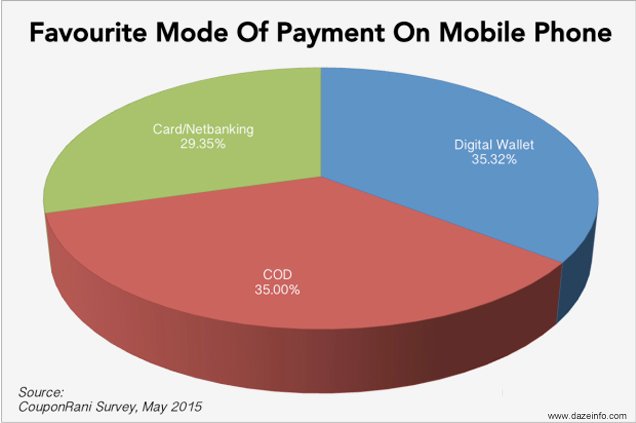

Some of the reasons why the e-commerce market has lagged behind in India include the relatively slow internet speeds, particularly outside the metros and other big cities, poor customer service and poor internet penetration. Most products do not have much digital representation, and a fragile economic state has ensured that people above the age of 35 rarely ever use credit or debit cards to buy products online. However, companies like Flipkart and Amazon have seen their sales grow rapidly due to the introduction of COD (Cash on Delivery), which Indian buyers find more comfortable.

The ecommerce industry is looking to target fresh ways of conquering the market. With the rapid increase in smartphone usage, companies are designing apps that allow direct purchase of retail on the internet from smartphones. Smartphone-based purchases make up nearly half of the sales made online by e-tailers such as Flipkart, Amazon or Jabong. By using mobile phones, SMS and emails, e-commerce retailers have managed to plug the gap between customer and service provider and this has lead to greater production. The digital advertisement industry is also changing the landscape of ecommerce in India.

With studies indicating a year-on-year growth of 30 percent in the digital advertisement industry, the digital reach and penetration of the ecommerce providers is also touching new heights. Big retailers, in order to maintain their relevance, are tying up with e-tailers so that these collaborative projects bring success. Amazon and Big Bazaar, Snapdeal and Croma represent two such alliances where one plays the role of technology and logistics adviser and facilitator while the other remains the traditional vendor. Furthermore, small and medium size retailers who supply products to the e-tailers are growing in number, because of the mutual profitability of such partnerships, as evidenced by the 30000 domestic sellers working with eBay India and further 15000 that sell globally. With the e-tailers serving as technological facilitators, the flow of goods for these retailers, and their audience, has increased manifold. This, in turn, feeds the growth of the ecommerce industry.

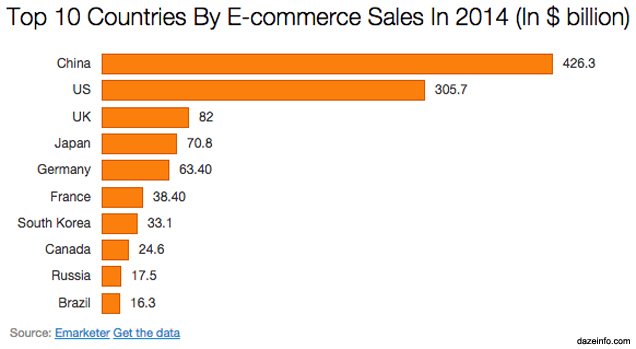

While a broadening vision of a digital market in India seems to hold a lot of promise for the growth of the ecommerce industry in India, it still has a lot to do before it is able to compete with global leaders. The improvement of internet infrastructure and payment gateways, such as the rise of Paytm, will eventually lead to India achieving the vast potential that its over 200 million internet users hold out for the ecommerce industry. As yet, however, India’s ecommerce industry is a mere fraction of that of leaders like China (only about 1/80th of China’s e-retail market’s size). Analysts and businessmen are hopeful, however, and claim with confidence that ecommerce is the future of Indian retail, and even Indian industry on the whole.

With the saturation of the e-commerce market in countries like the UK, the US or Japan, investors have found that entering emerging markets like India, China or Brazil would provide rapid growth, and are therefore making an effort to increase both internet penetration as well as more lucrative offers. Analysts say that while in the US or Japan and even China, the e-market industry had its first boom in the early 2000s, in India, the growth spurt has really begun in the last four or five years. China alone, of all the emerging economies, has managed to capture a big piece of the e-commerce pie. With superior infrastructure and increased investor interest in the Chinese market, the analysts project that in the next five years, China is expected to cross $1 trillion in retail e-commerce by 2018, surpassing the US to hold about 40 percent of the global market. China’s ability to draw in the global markets and its rapid industrialisation and mechanisation have contributed to this growth of retail ecommerce, with most internet users also comfortable with credit or debit card usage. Quality control also plays a big role in this growth. China, although not among the top five markets with digital-buyer penetration, still has a greater reach than India, and many other emergent economies.

Trust and reliability play an indispensable role in the success of an e-commerce start up in India. Both analysts and users complain that outside the big cities, customer services are sometimes very poor. The quality of products delivered is often below par. Also, due to poor communication and internet infrastructures, the products often go through inordinate delays before turning up at the customer’s doorstep. As the user is promised quick delivery as an added perk of ecommerce, such delays only reduce his faith in such companies, and drive him towards traditional, physical markets. Economic barriers and lower average incomes are also a hindrance for the e-commerce industry as people are more careful with their money, with experts saying that only a fraction of those who visit internet e-commerce sites actually make purchases. Bureaucratic processes and safety checks are greater in number in some parts of India, and this also causes difficulties to the ecommerce medium, which relies on swift, dynamic mode of exchange. But the e-commerce players are putting their best foot forward to turn India into a profitable market for this industry.